India's PAN 2.0: Streamlining Compliance And Strengthening Digital Identity For A Secure Future

PAN 2.0 revolutionizes digital identity verification, boosting India’s Ease of Doing business and supporting its Digital India goals

India's PAN 2.0: Streamlining Compliance And Strengthening Digital Identity For A Secure Future

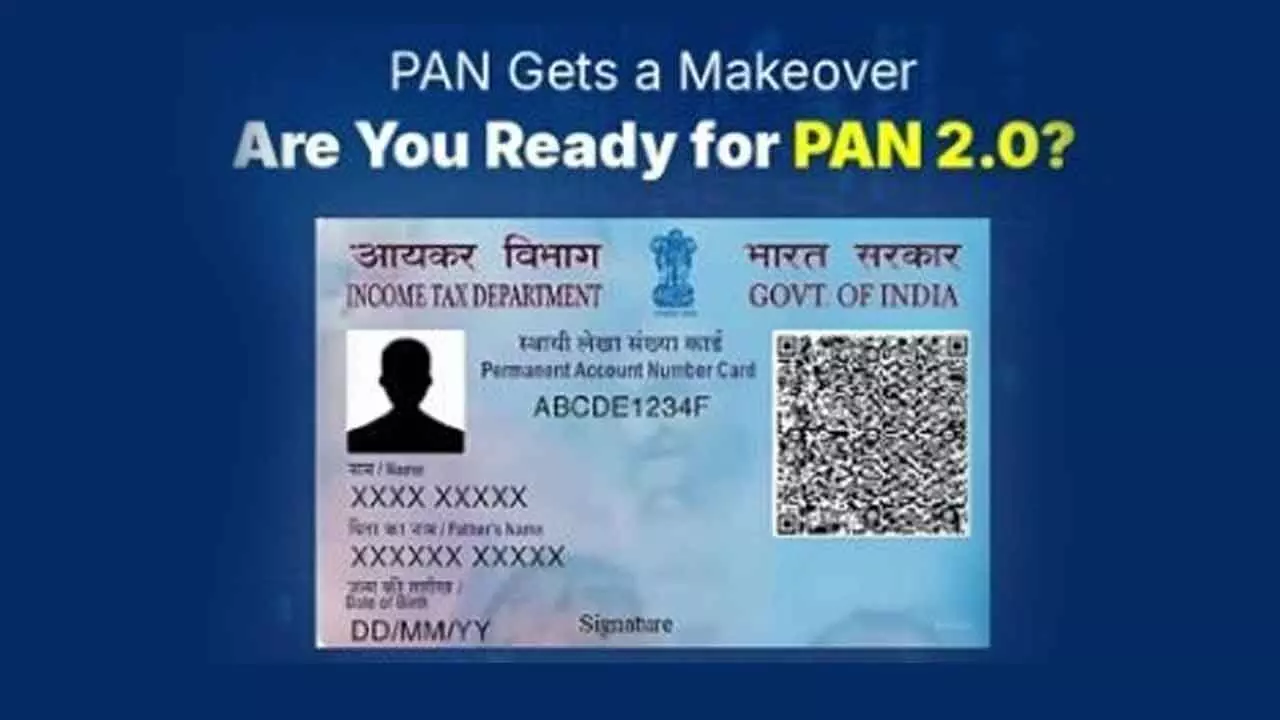

The government’s rollout of PAN 2.0 promises to streamline compliance and simplify the on-boarding process for businesses and individuals alike. By introducing features like QR codes and real-time digital verification, PAN 2.0 enhances security, reduces regulatory redundancies, and strengthens India's digital ecosystem, setting the stage for a more efficient and secure digital economy

Mumbai: The government’s recent announcement of PAN 2.0 has sparked interest, particularly within India’s fintech ecosystem. Designed to enhance the ease of doing business, PAN 2.0 aligns with the broader objectives of the Digital India initiative, providing a more streamlined, efficient, and secure framework for digital transactions and identity verification.

In an exclusive conversation with Bizz Buzz, Rohit Mahajan, Co-founder of plutosONE, remarked, “PAN 2.0 is a revolutionary step toward achieving India’s goal of a digitally empowered economy. It goes beyond just a legal update; it’s a catalyst for change in how businesses and consumers interact in the digital space.”

For millions of Indians who remain underserved by traditional banking systems, PAN 2.0 aims to simplify compliance processes and expedite on-boarding procedures. This change is critical to strengthening customer-bank relationships and improving financial access across the country.

“The innovation of PAN 2.0, including real-time digital verification, makes it easier to innovate and provide more reliable solutions to customers,” Mahajan added. “Whether it's through merchant-funded offers platforms, conversational AI for bill payments, or biller on-boarding, PAN 2.0 has the potential to improve financial experiences across the board.”

PAN 2.0 is also expected to enhance transparency, scalability, and the overall cohesiveness of India’s digital ecosystem, contributing to the government’s push for greater openness.

Rishi Agrawal, CEO and Co-Founder of Teamlease Regtech, pointed out the complexity of India’s regulatory framework, which currently requires businesses to manage multiple forms of identification, including PAN, GSTN, and Professional Tax Numbers, among others. “This labyrinth of identification layers hinders the ease of doing business,” Agrawal said.

PAN 2.0 seeks to transform this landscape by integrating secure, technology-driven features, such as QR codes and a unified portal, making it easier for businesses to comply with regulations. This will not only improve tax administration but also strengthen India’s identification infrastructure by addressing critical issues like data consistency, streamlined processes, and enhanced cybersecurity.

“The government’s allocation of Rs1,435 crore demonstrates its commitment to creating a unified source of truth for enterprises,” Agrawal added. “With the introduction of initiatives like an enterprise DigiLocker and a National Open Compliance Grid (NOCG), India is moving toward a paperless, cashless, and presenceless economy.”

These initiatives are designed to reduce regulatory redundancies and streamline compliance obligations, helping to foster a seamless digital governance ecosystem. This shift is a critical step in realizing India’s Vision 2047 – a Viksit Bharat and a $10 trillion economy.

Abhishek Saxena, MD and Co-Founder of OmniCard, emphasized the role of PAN 2.0 in transforming the digital ecosystem. “The introduction of PAN 2.0, with features like QR codes, will make the entire PAN framework more seamless and efficient,” he said.

The upgrade strengthens fraud detection mechanisms, enabling faster and more secure authentication processes. Improved data synchronization will streamline interactions with government agencies, enhance KYC processes, and ensure smoother verifications, ultimately reducing the risk of identity theft and payment fraud.

By fostering a more secure and efficient digital economy, PAN 2.0 is set to become a cornerstone of India’s ongoing digital transformation.